Cost of Car Insurance for Teens Explained

Are you a parent considering car insurance for your teen? It’s important to understand the factors that influence the cost of car insurance for teenage drivers. Insurance companies typically charge higher rates for teens due to their higher risk of accidents compared to more experienced drivers.

Adding a 16-year-old to an adult’s auto insurance policy can cost around $250 per month on average. However, this cost can vary depending on factors such as the type of vehicle, the teen’s age, gender, driving history, and the amount of coverage included in the policy.

To help you navigate the world of car insurance for teens, we have gathered helpful information about the average cost, factors affecting insurance rates, and ways to save money. We have also listed the top insurance companies for teen drivers and highlighted available discounts.

Key Takeaways:

- Car insurance for teens is generally more expensive than for older drivers.

- The cost of car insurance for teens depends on factors such as age, gender, driving history, type of vehicle, and coverage amount.

- Adding a teen to an adult’s policy can cost around $250 per month on average.

- There are ways to save money on car insurance for teens, including taking advantage of available discounts.

- Progressive, Geico, Allstate, and Farmers Insurance are top insurance companies for parents looking to add a teen to their policy.

Factors Affecting Car Insurance Costs for Teens

When it comes to car insurance for teens, several factors come into play that can affect the cost of their premiums. Insurance companies take these factors into consideration to determine the rates for teen drivers.

Age

The age of the teen driver is a significant factor that impacts car insurance rates. Younger drivers, such as those in their early teens, generally pay higher premiums compared to older teens who have obtained more driving experience. This is because younger drivers are considered riskier and statistically more likely to be involved in accidents.

Gender

The gender of the teen driver can also influence the cost of car insurance. Insurance companies may charge different rates for male and female teen drivers based on historical data that shows differences in driving behaviors and accident rates between the two genders. These differences can impact the perceived risk associated with insuring a particular gender, leading to variations in insurance premiums.

Driving History

The driving history of the teen driver is another crucial factor that insurance companies consider when determining car insurance rates. If the teen has a history of accidents, traffic violations, or claims, it can indicate a higher risk and result in higher premiums. On the other hand, a clean driving record with no previous incidents can lead to lower insurance costs.

Type of Vehicle

The type of vehicle that the teen driver intends to drive can also affect the cost of car insurance. Sports cars and high-performance vehicles are generally more expensive to insure due to their increased risk of accidents and higher repair costs. On the other hand, sedans or family cars with good safety ratings may result in lower insurance premiums.

Amount of Coverage

Lastly, the amount of coverage included in the policy can impact the cost of car insurance for teens. Comprehensive coverage, which provides protection for not only accidents but also theft, vandalism, and other incidents, tends to be more expensive compared to basic liability coverage. Teens and their parents should consider the level of coverage they need and balance it with their budget to find the right balance between protection and affordability.

By taking these factors into account, insurance companies assess the risk associated with insuring teen drivers, which ultimately influences the premiums they charge. Teenagers who are considered higher risk may face higher insurance costs as a result.

| Factors | Impact on Car Insurance Costs |

|---|---|

| Age | Younger drivers generally have higher premiums compared to older teens. |

| Gender | Insurance rates may vary for male and female teen drivers. |

| Driving History | A clean driving record can lead to lower insurance costs, while previous accidents or violations can increase premiums. |

| Type of Vehicle | Sports cars and high-performance vehicles may result in higher insurance premiums. |

| Amount of Coverage | Comprehensive coverage tends to be more expensive compared to basic liability coverage. |

Average Cost of Car Insurance for Teens

The average cost to add a 16-year-old to an adult’s existing auto insurance policy is about $250 per month. However, this cost can vary depending on the insurer and policyholder. Other factors such as the type of vehicle and the amount of coverage also impact the price.

Adding a teenage driver to an insurance policy often comes with higher costs due to the increased risk associated with this age group. Insurance companies view teen drivers as inexperienced and more prone to accidents, which leads to higher premiums.

To help illustrate the average cost of car insurance for teens, consider the following table:

| Age | Monthly Premium |

|---|---|

| 16 | $250 |

| 17 | $225 |

| 18 | $200 |

| 19 | $175 |

Please note that these figures are just estimates and can vary based on several factors, including the individual’s driving history and the coverage options chosen. Additionally, different insurance providers may offer different rates, so it’s crucial to shop around and compare quotes to find the most affordable option.

It’s important to emphasize that while car insurance for teens can be expensive, there are ways to save money. Taking advantage of available discounts, such as good student discounts or completing a defensive driving course, can help reduce premiums. Additionally, maintaining a clean driving record and choosing a safe and reliable vehicle can contribute to lower insurance costs.

In the next section, we will explore some examples of car insurance quotes for teens, including common discounts available to this age group.

Example Pricing and Discounts

When it comes to car insurance for teens, the cost can vary significantly depending on various factors. However, there are discounts available that can help lower the price. Here are some example car insurance quotes for teens, showcasing common discounts:

| Insurer | Quote | Discounts Applied |

|---|---|---|

| ABC Insurance | $200 per month | Good student discount, safety discount |

| XYZ Insurance | $250 per month | Defensive driving course discount |

| 123 Insurance | $300 per month | Good student discount, multivehicle discount |

These example quotes demonstrate the variation in pricing and the importance of taking advantage of car insurance discounts for teens. Insurers offer discounts such as good student discounts, safety discounts, defensive driving course discounts, and more. By qualifying for these discounts, teen drivers can save a significant amount on their car insurance premiums.

Top Insurance Companies for Teen Car Insurance

If you’re a parent looking to add a teen driver to your car insurance policy, it’s essential to find the best insurance provider that offers competitive rates and comprehensive coverage. After careful research and analysis, we have identified the top insurance companies for teen car insurance:

- Progressive

- Geico

- Allstate

- Farmers Insurance

These insurance companies are known for providing excellent options for parents who want to add a newly licensed teen driver to their policy. With their comprehensive coverage and attractive rates, they offer the best options for both adult and teen drivers.

Choosing the right insurance company is crucial for teen drivers. It not only ensures that your child is adequately protected on the road but also helps you save money by offering competitive rates and discounts specifically tailored for teens.

Each of these insurance providers has its unique offerings and benefits for teen car insurance. By comparing quotes from these top insurance companies, you can find the best coverage and rates that suit your specific needs.

When selecting an insurance company for your teen driver, it’s essential to consider factors such as coverage options, customer service, and discounts available. These top insurance providers have earned their reputation for providing reliable and affordable car insurance for teen drivers.

Comparison of Top Insurance Companies for Teen Car Insurance

| Insurance Company | Benefits | Discounts | Rates |

|---|---|---|---|

| Progressive | Wide range of coverage options | Good student discount, safe driving discount | Competitive rates |

| Geico | 24/7 customer service, customizable coverage | Good student discount, safe driving discount | Affordable rates |

| Allstate | Dedicated agents, personalized support | TeenSMART discount, safe driving bonus | Competitive rates |

| Farmers Insurance | Flexible coverage options, strong financial stability | Good student discount, driver training discount | Attractive rates |

Discounts for Teen Drivers

When it comes to car insurance for teen drivers, there is good news. Many car insurance providers offer a variety of discounts that can help reduce the cost of coverage for young drivers. These discounts are designed to make car insurance more affordable and accessible to teenagers and their families.

Here are some of the common car insurance discounts available for teen drivers:

- Good student discounts: This discount is available to students who maintain a certain grade point average (usually a B or higher). Insurers view good students as responsible and less likely to engage in risky driving behavior.

- Safety discounts: Some insurance companies offer discounts to teens who complete a driver’s education course or defensive driving program. These programs provide valuable knowledge and skills that can help teen drivers avoid accidents.

- Bundle discounts: Families who have multiple vehicles or multiple insurance policies (such as homeowners or renters insurance) with the same company may qualify for bundle discounts. These discounts can significantly reduce the overall cost of car insurance.

- Multi-vehicle discounts: If your household has more than one vehicle, you may be eligible for a multi-vehicle discount. This discount rewards families for insuring multiple vehicles with the same insurance provider.

Taking advantage of these discounts can help save a significant amount of money on teen car insurance. It’s important to note that not all insurance providers offer the same discounts, so it’s worth shopping around and comparing quotes from different companies to find the best deal.

Check out the example below to see how discounts can impact the cost of car insurance for teen drivers:

Example Quote:

Insurance Provider Base Premium Good Student Discount Safety Discount Total Premium ABC Insurance $300 per month $30 per month $25 per month $245 per month XYZ Insurance $350 per month $50 per month $20 per month $280 per month

This example shows how different insurance providers can offer varying discounts, resulting in different total premium amounts. By comparing quotes and taking advantage of available discounts, families can save money on teen car insurance without sacrificing coverage.

Adding a Teen Driver to Your Policy

When it’s time to add a teen driver to your car insurance policy, the process is straightforward. You can start by contacting your current auto insurer and making the request. They will guide you through the necessary steps and provide you with all the information you need to add your teen to your policy.

Here are the details you will likely need to provide:

- Name: Provide the full name of the teen driver.

- License or permit information: Share the details of their driver’s license or permit.

- Date of birth: Provide the teen’s date of birth as required.

- Driving history: Share any relevant driving history of the teen driver.

It’s important to note that adding a teen driver to your policy may increase your premium. Insurance companies consider teen drivers to be higher risk due to their limited driving experience. However, there are ways to mitigate this increase and potentially save on your premium.

If you prefer to explore other insurance options, you can also obtain coverage for your teen through a new insurance provider. To do this, you can start by requesting an online quote from different insurance companies and compare the rates and coverage options they offer.

“Adding a teen driver to your car insurance policy doesn’t have to be complicated. By providing the necessary information to your current insurer or exploring new insurance options, you can ensure your teen has the coverage they need while finding the best rates for your family.”

How to Save Money on Car Insurance for Teens

When it comes to car insurance for teens, finding affordable rates can be a challenge. However, there are several strategies you can implement to save money and secure affordable car insurance for young drivers. By following these tips, you can lower the cost of car insurance for your teen without compromising on coverage.

-

Choose an Affordable Car

One of the key factors that affect the cost of car insurance for teens is the type of vehicle they drive. Expensive or high-performance cars often come with higher insurance premiums. Opting for a more affordable, reliable vehicle can help save money on insurance costs. Consider factors such as the car’s safety features, age, and overall reliability when selecting a car for your teen.

-

Review Coverage and Deductibles

Take the time to review your car insurance policy and consider adjusting your coverage and deductibles. While it’s important to have adequate coverage, having excessive coverage can result in higher premiums. Evaluate your teen’s driving habits and the amount of coverage you truly need. By adjusting your coverage and deductibles, you can find a balance between cost and protection.

-

Shop Around for Coverage

Don’t settle for the first car insurance quote you receive. Take the time to shop around and compare rates from different providers. Each insurance company calculates rates differently, so you may find significant differences in pricing. Collect quotes from multiple insurers and compare the coverage and premiums offered. This way, you can find the most affordable car insurance for your teen without compromising on quality.

Implementing these strategies can help you save money on car insurance for teens. By choosing an affordable car, reviewing coverage and deductibles, and shopping around for coverage from different providers, you can find affordable car insurance that meets your teen’s needs. With the right approach, you can provide your teen with the protection they need on the road without breaking the bank.

| Cost-Saving Strategy | Benefits |

|---|---|

| Choosing an affordable car | – Lower insurance premiums – Reduced maintenance and repair costs |

| Reviewing coverage and deductibles | – Potential savings on premiums – Ability to customize coverage based on needs |

| Shopping around for coverage | – Access to competitive rates – Opportunity to find the best coverage for the price |

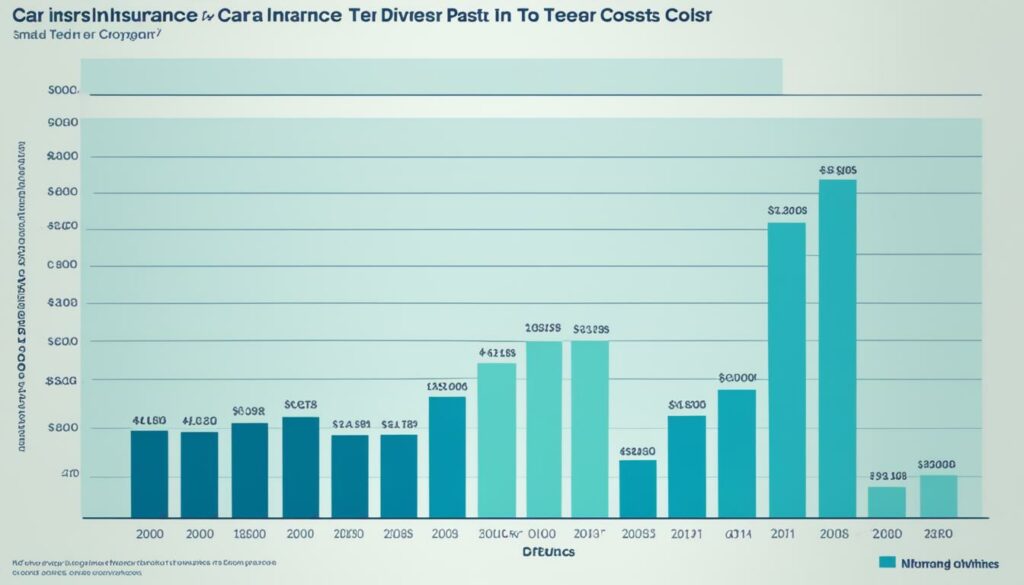

Cost of Car Insurance for Different Age Groups

When it comes to car insurance, age is a significant factor that insurance companies consider when determining premiums. Generally, the cost of car insurance decreases between the ages of 18 and 25. However, teenagers and young adults tend to pay the highest rates, reflecting their higher risk as newer drivers. Insurance companies perceive younger drivers as less experienced and more prone to accidents, leading to higher premiums.

Teens face the highest car insurance rates due to their limited driving experience. This group is more likely to engage in risk-taking behaviors and be involved in accidents. Young adults, while having more driving experience than teenagers, still face higher rates compared to older adults. It is only after the age of 25 that insurance rates tend to level off, as drivers gain more experience and are considered less risky.

Insuring drivers in different age groups involves assessing the likelihood of accidents and claims. As experience and maturity increase, insurance providers tend to view drivers as less of a risk, resulting in lower premiums. However, it’s important to note that individual factors such as driving history, type of vehicle, and coverage amount can also impact insurance costs.

Why Car Insurance for Teens is Expensive

Car insurance for teens is notorious for its high cost, and there are several reasons why this is the case. One primary factor is the higher risk of accidents associated with teen drivers compared to more experienced ones. According to statistics, teen drivers are more likely to be involved in fatal car accidents than drivers over the age of 20.

Insurance companies consider this increased risk when calculating premiums, leading to higher insurance costs for teenage drivers. The higher likelihood of accidents translates into a greater probability of filing claims and incurring expenses for insurers. To mitigate these risks, insurance providers adjust their rates for teen drivers accordingly.

It’s important to note that the high cost of car insurance for teens is not solely based on their age. Other factors, such as the type of vehicle driven, the teen’s driving history, and the coverage amount, also contribute to the overall price. However, the increased risk associated with teen drivers remains a significant driver of the high insurance premiums they face.

To better understand the impact of the high cost of teen car insurance, let’s take a look at a comparison table showcasing the average annual premiums for different age groups:

| Age Group | Average Annual Premium |

|---|---|

| 16-19 years old | $4,875 |

| 20-24 years old | $2,304 |

| 25-29 years old | $1,708 |

This table clearly illustrates the significant difference in car insurance costs between teenage drivers and older age groups. As shown, the average annual premium for 16-19-year-olds is almost double that of 20-24-year-olds.

It’s worth noting that these figures represent average premiums and can vary based on individual circumstances, such as driving record, location, and chosen coverage options.

Insuring a teenage driver can be expensive, but there are steps parents and teens can take to potentially reduce the cost. By exploring different insurance providers, seeking out available discounts, and promoting responsible driving habits, families can help make car insurance more affordable for teen drivers.

Average Cost of Car Insurance for Teenagers by Age

When it comes to car insurance for teenagers, the cost can vary depending on their age. On average, a teenager can expect to pay around $243 per month for an individual policy. However, as with any insurance, this cost can fluctuate based on a variety of factors.

Younger teenagers, typically between the ages of 16 and 17, tend to face higher rates compared to older teenagers. This is because younger drivers are considered riskier by insurance companies due to their lack of driving experience. As teenagers grow older and gain more experience behind the wheel, insurance rates generally decrease.

It’s important to note that these are average costs, and individual rates may vary. Insurance providers take many factors into consideration when determining premiums, including driving history, type of vehicle, and coverage options chosen.

When shopping for car insurance for teenagers, it’s crucial to compare quotes from different providers to ensure you’re getting the best rate possible. Taking the time to research and understand your options can help you find affordable coverage for your teenage driver.

Average Car Insurance Costs for Teenagers by Age

| Age | Average Monthly Cost |

|---|---|

| 16 | $300 |

| 17 | $275 |

| 18 | $250 |

| 19 | $225 |

| 20 | $200 |

Keep in mind that the figures in the table above are just estimated averages and can vary depending on various factors. These figures should be used as a general guideline to get an idea of potential costs for car insurance for teenagers based on age.

Conclusion

In conclusion, car insurance for teens is generally more expensive than for older drivers. This is due to several factors that influence the cost, including age, gender, driving history, and coverage amount. Teenage drivers are considered higher risk by insurance companies, leading to higher premiums.

To save money on car insurance for teens, it is important to take advantage of available discounts. These can include good student discounts, safety discounts, defensive driving course discounts, and more. Additionally, comparing quotes from different insurance providers can help find the most affordable coverage.

By being proactive and seeking out discounts and competitive quotes, parents and teen drivers can potentially lower the cost of car insurance and ease the financial burden of insuring a teenager. It is important to prioritize the safety and protection of teen drivers while also considering cost-saving measures.

FAQ

How much is car insurance for teens?

Car insurance for teens generally costs more than for older drivers. The average cost to add a 16-year-old to an adult’s policy is about $250 per month.

What factors affect the cost of car insurance for teens?

The cost of car insurance for teens is influenced by factors such as the teen’s age, gender, driving history, type of vehicle, and coverage amount.

What is the average cost of car insurance for teens?

The average cost of car insurance for a teenager is $243 per month for an individual policy.

Can teens get discounts on car insurance?

Yes, most car insurance providers offer discounts for teen drivers. These can include good student discounts, safety discounts, defensive driving course discounts, and more.

Which are the top insurance companies for teen car insurance?

Progressive, Geico, Allstate, and Farmers Insurance are listed as the top insurance companies for parents looking to add a teen to their policy.

How can I add a teen driver to my car insurance policy?

You can typically add a teen driver to your car insurance policy by contacting your current auto insurer and providing the necessary information about the teen driver. It is also possible to get coverage for a teen through a new insurance provider by starting with an online quote.

How can I save money on car insurance for my teen?

You can save money on car insurance for teens by choosing an affordable car, reviewing coverage and deductibles, and shopping around for coverage with different providers.

Why is car insurance for teens expensive?

Car insurance for teens is expensive because they are considered higher risk due to their lack of driving experience. Teen drivers are more likely to be involved in accidents than more experienced drivers.

How does the cost of car insurance change as teens get older?

The cost of car insurance generally goes down between the ages of 18 and 25. Teens pay the highest rates, followed by young adults. Rates begin to level off after age 25.